#1 CRYPTOCURRENCY TAX SOFTWARE

Crypto tax made simple

Calculate your DeFi, NFT, & crypto taxes in minutes. The ultimate solution for a stress-free tax season.

Super fast personal tax filing

Our new partnership with april allows you to complete your entire tax return and e-file without ever leaving the app.

Trusted By

Rated best crypto tax software for tax professionals by Fortunly

- Crypto Tax

- Tax Filing

Crypto tax

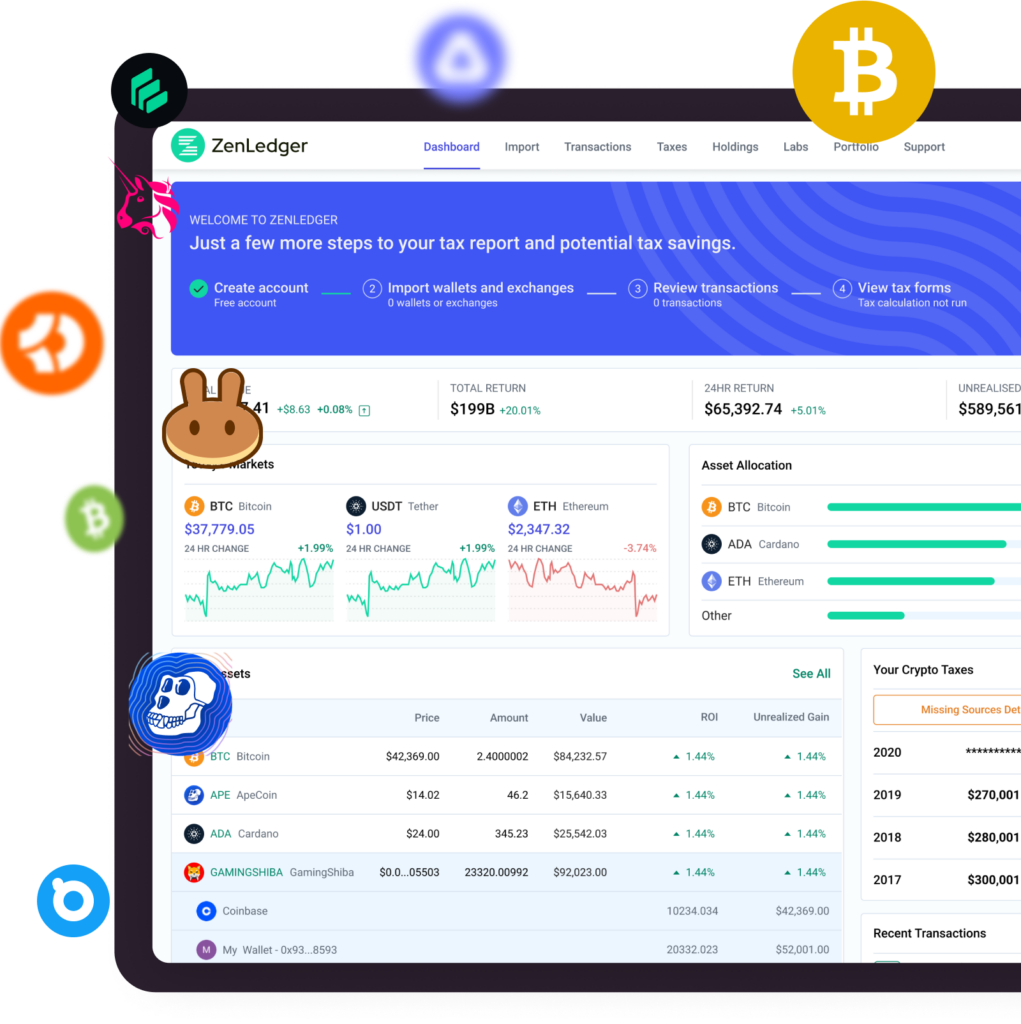

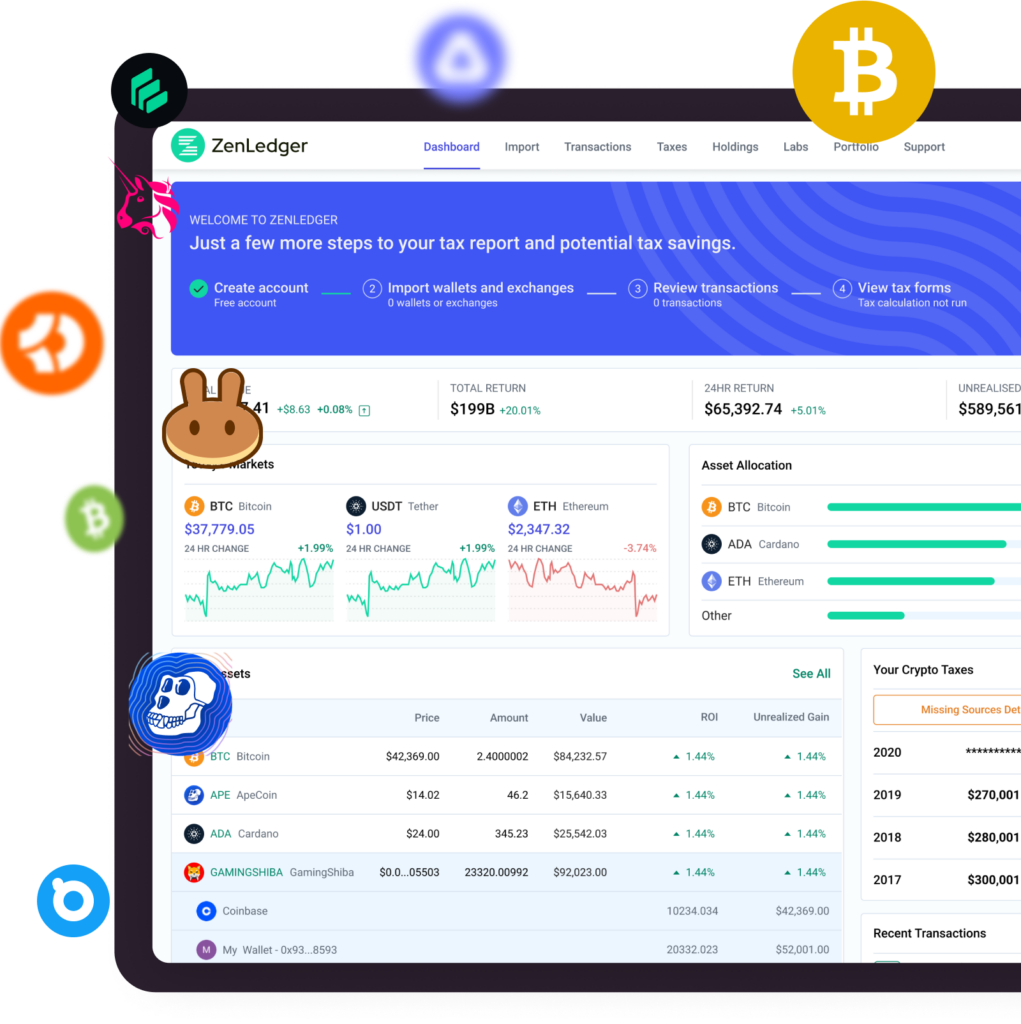

Crypto tax made simple

- Track your trades

- See your profits/losses

- Never overpay on your crypto taxes again!

Tax return

A streamlined tax return experience

- End-to-end tax filing, including e-file. Powered by april

- One straight-forward flat rate price for W-2 's, 1099 's, and more

- Import your Crypto Tax Forms with a single click

DIY Crypto Taxes

Competitively priced crypto tax filing software or full-service plans to meet your needs.

Tax filing made simple

With ZenLedger and april you can e-file your full tax return saving you time and money.

Tax professionals

Accountants and CPAs can easily manage client accounts from a single interface.

Premium support

Our team have a passion for helping our clients get their taxes done right

- Get a response in just a few minutes

- FAQ articles available in our robust online help center

- Support via phone, video, or chat with our in-house experts

Morgan

Customer Service Expert

Megan

Customer Service Expert

Mike

Customer Service Expert

Easy as 1,2,3

Crypto taxes made simple

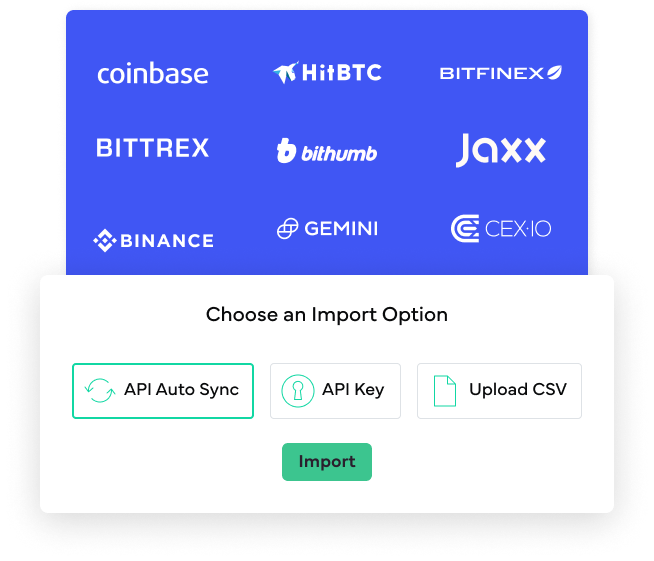

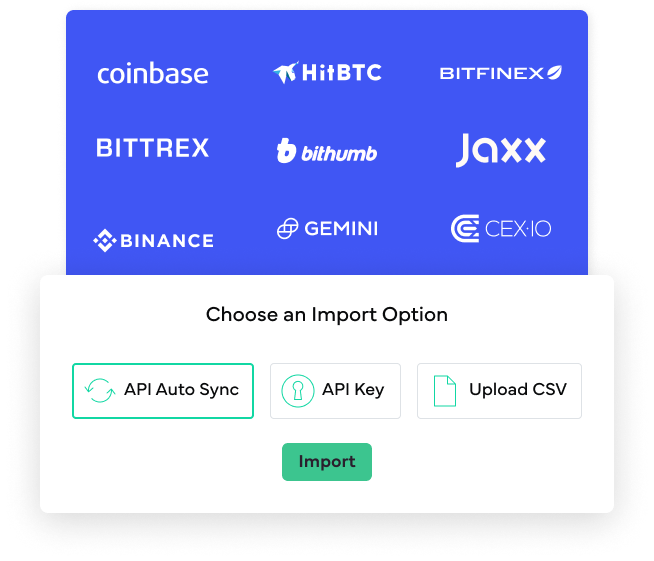

Import your exchanges

ZenLedger will automatically calculate cost basis, fair market value, and gains/losses for your transaction history.

Review your transactions

Easily calculate your capital gains and losses, and view tax liability for every cryptocurrency transaction.

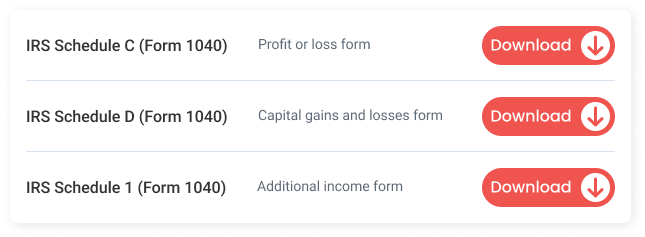

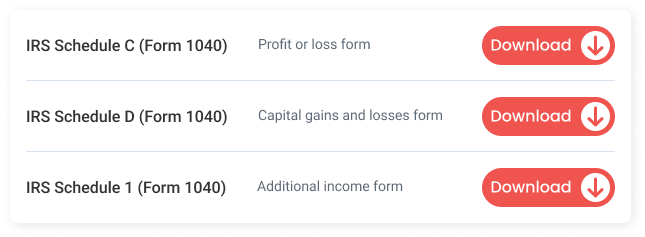

Download your forms

After reviewing your reports and ensuring accuracy, the final step is to generate your tax reports and file them!

Advanced Tools And Resources

Reasons to love ZenLedger

Pricing

The best pricing in the industry, including a free plan.

Tax filing

One Tax Return. One Platform Experience. No more Tab Toggling.

Premium support

Our customer support team is here to help you 7 days a week, including evenings, by chat, email, phone or video calls.

Tax loss harvesting tool

Save money and trade smarter. Detailed report included in all plans.

Grand Unified Spreadsheet

See all your transaction details in one, easy to read spreadsheet.

Security and encryption

We care deeply about your privacy and offer 2FA (two-factor authentication).

As Seen In

Still not sure? Our customers say it best.

Exchanges and Integrations

Over 400+ exchanges, 100+ DeFi protocols, and 10+ NFT platforms.

ZenLedger’s crypto tax tool supports more exchanges, coins, wallets, blockchains, fiat currencies, and DeFi & NFT protocols than our competitors, and we are always adding new integrations.

Swinging Markets and Sentiments: What’s Behind the Massive Bitcoin Outflows?